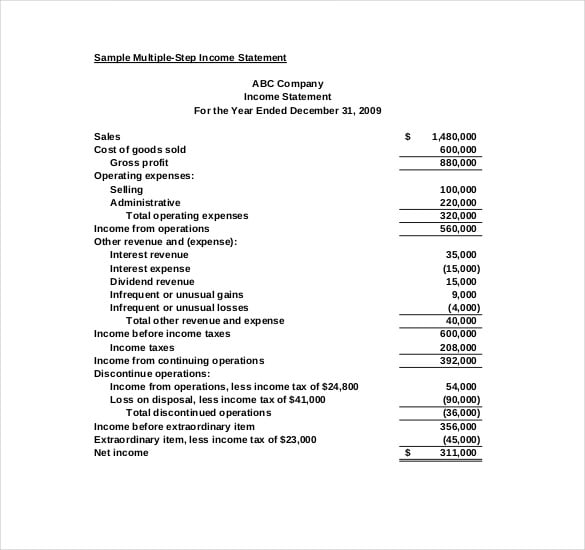

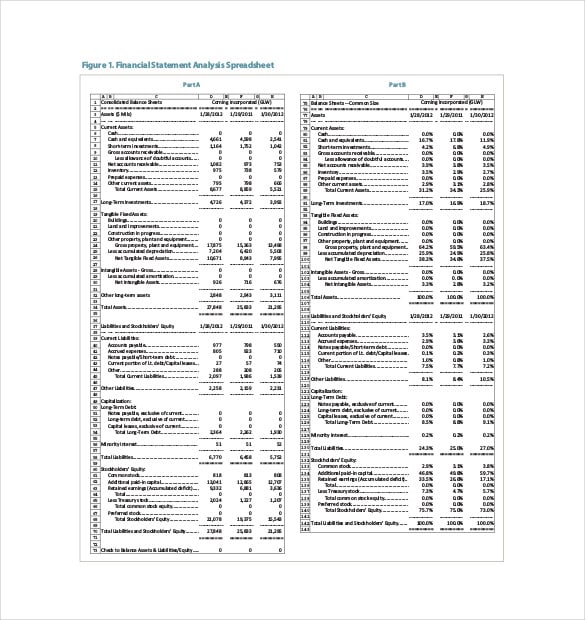

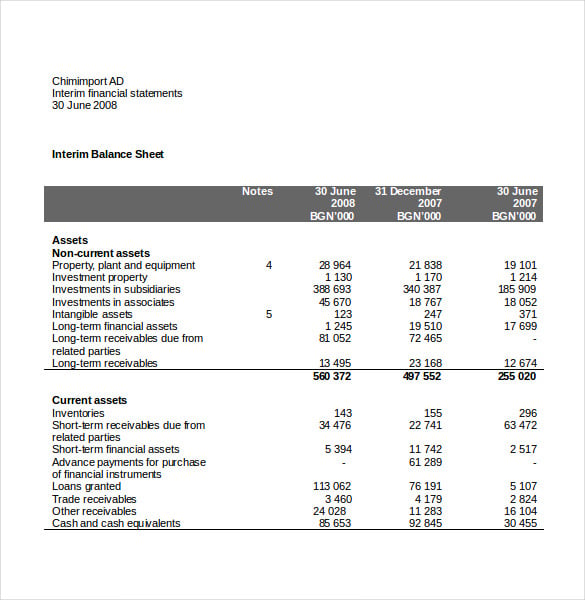

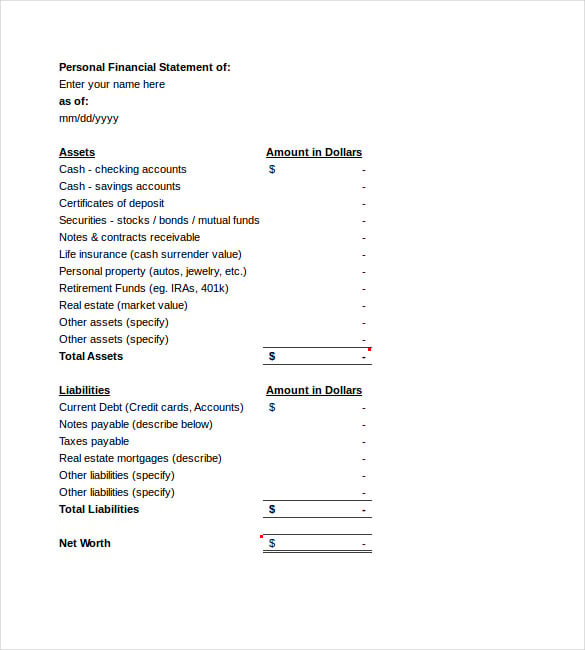

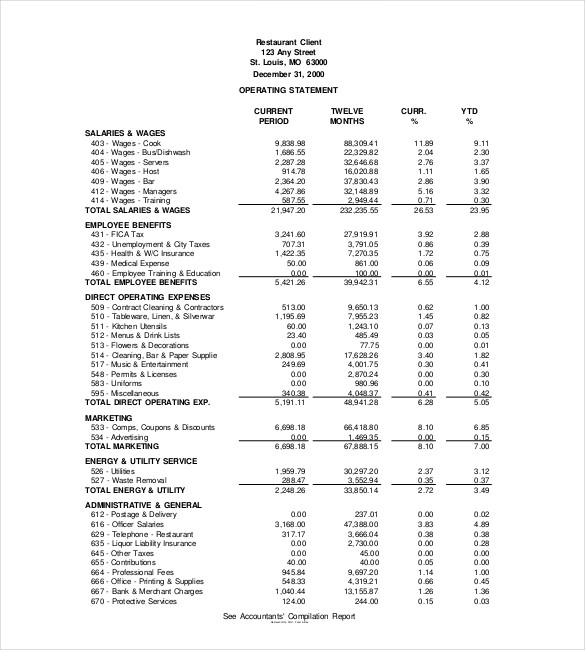

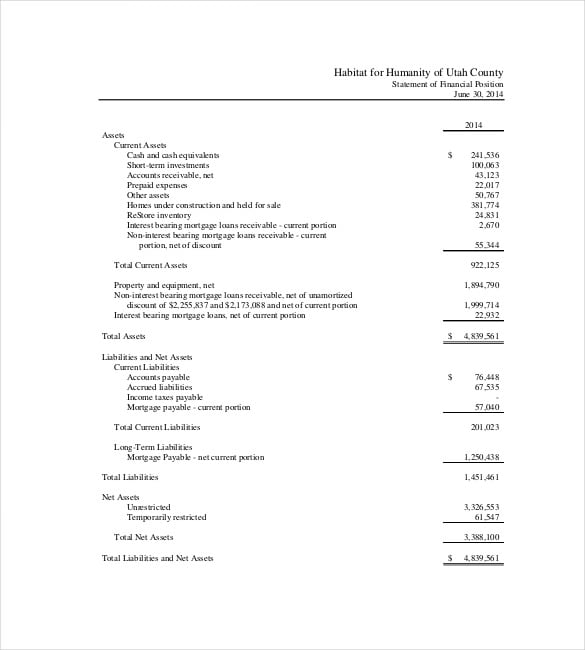

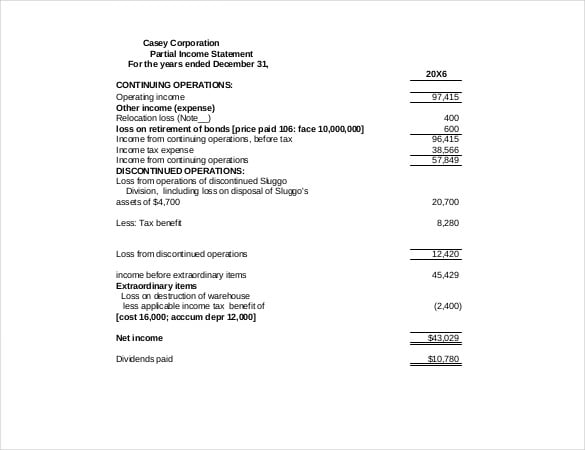

An income statement template summarizes the expenses and profit of a company to describe about the present condition of your business and company. It shows the financial performance of a company and generally used in combination with a balance sheet template. Moreover, this template includes sales revenue plan, cost of goods sold, total or specific general expenses, depreciation expense, interest expense, tax expense and all other expenses. A professional income statement describes about the benefits and loss of both operating and non-operating activities and gives a summary of financial performance of your business. The statement is used in management work of a company but investors and creditors which are the outside partner of the company to evaluate performance and profitability. Income statement is further depended on three parts i.e. total expenses, total revenue and net income. It is based on basic equation with the formula of;

Revenues – Expenses = Net income.

All the companies need to generate interest and profit to stay on preferable level in business.

Details of Income Statement Template

Profits and interests are used to pay expenses, interest payment for debt, taxes which is payable to the government and many other purposes. Income statement plays an important role to present the financial result of a business used by accountants and business owners. In other words, people need professional income statement templates that can help them to generate an excellent format to find out true data. Therefore, our users can find multiple free income statement templates in this page, which they can use in various project. In addition, these templates will help them avoiding time loss and can prevent them from different disasters. It is being presented and designed by our professionals with their valuable skills. Our provide income statement template is extremely different from others and can use multiple time according to your need. It is a high quality template without any need of amendment and impressively available on our website.